pada tanggal

Love

- Dapatkan link

- Aplikasi Lainnya

The idea of money laundering is very important to be understood for these working within the monetary sector. It is a process by which dirty money is converted into clear cash. The sources of the cash in precise are prison and the cash is invested in a means that makes it look like clear money and hide the identity of the felony a part of the money earned.

Whereas executing the financial transactions and establishing relationship with the brand new prospects or sustaining existing clients the responsibility of adopting ample measures lie on each one who is part of the organization. The identification of such element to start with is easy to deal with instead realizing and encountering such situations afterward within the transaction stage. The central financial institution in any country supplies complete guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present sufficient safety to the banks to deter such situations.

According to the Report from the Commission to the European Parliament and to the Council on the assessment. Contentbusiness risk financial risk reputational risk money laundering risk and transaction laundering risk.

What Are High Risk Industries Detailed List Of High Risk Industries

Money laundering high risk businesses. The risk of money laundering and terrorist financing is constantly evolving. On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk. Armament manufacturers dealers and intermediaries.

Customers in these categories can pose an inherently high risk for money laundering. Businesses which comply with the AMLCTF regime reduce their risk of being exploited by organised crime for money laundering purposes. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks.

The extent and quality of EDD measures must be commensurate with the risks identified. The following factors may be used to identify the risks. Recommendation 12 where there is a higher-risk business relationship.

The objective is to increase the firms understanding of the risks associated with such customers so they can mitigate these risks effectively. New customers carrying out large one-off transactions a customer whos been introduced to you -. The Institute of Financial Accountants IFA is urging accounting firms to employ vigilance now more than ever as it encourages.

MLTF business risk is significantly influenced by where the business operations are located the use of third parties and the MLTF risks resulting from employees. F ueled by recent high profile cases such as HSBCs 19 billion money laundering fine banks have been taking a good look at their risk profile. Firms should regularly review this webpage to make sure they have identified all the areas relevant to their own business.

Your business might be at risk of money laundering from. When conducting a risk assessment of cash-intensive businesses banks should direct their resources to those accounts that pose the greatest risk of money laundering or terrorist financing. Money laundering and terrorist financing pose different risks to accountants HM Treasurys National Risk Assessment found accountants to be at greater risk from money laundering.

The elusive greater amount of risk in the particular case of merchant underwriting can be identified in five main areas at least in our methodology. While most Cash Intensive Businesses CIBs are conducting legitimate business some aspects of these businesses may be susceptible to money laundering or terrorist financing. This has resulted in many banks terminating banking services for money services businesses MSBs.

A growing number of business types could be considered high-risk. Identifying and assessing risk was an important theme running through the Money Laundering Regulations 2007 MLR07 and firms were encouraged to assess the risks faced by the business as well as the risk that clients would be involved in money laundering or terrorist financing. Cash Intensive Businesses Managing Their Money Laundering Risks.

Barclays for example took the decision in 2013 to close around 250 MSB accounts 1 which has had a huge impact on local expatriate. FFIEC BSAAML Examination Manual 322 2272015V2 Cash-Intensive Businesses Overview. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes.

This scrutiny stands at the forefront of the effort to detect and deter the laundering of proceeds of corruption and is certainly necessary. MLTF business risk is the risk or vulnerability of a business operations customers to money laundering or terrorist financing activities. Been identified with potentially higher money laundering risks.

The premise behind the effort is clear. Money laundering strategies are constantly evolving with The National Risk Assessment NRA of Money Laundering and Terrorist Financing warning that the risk that accountancy service providers could be used to facilitate money laundering is considered high. Businesses benefit when regulatory actions detect and disrupt undermining criminal activities such as embezzlement of.

Firms must also monitor higher risk business. 323 EDD is required in certain higher risk situations as well as where firms assess there is an increased risk of money laundering or terrorist financing associated with their customers. High value products or services offer those seeking to undertake money laundering and the financing of terrorism the opportunity to move illicit funds in large amounts with.

Eu Policy On High Risk Third Countries European Commission

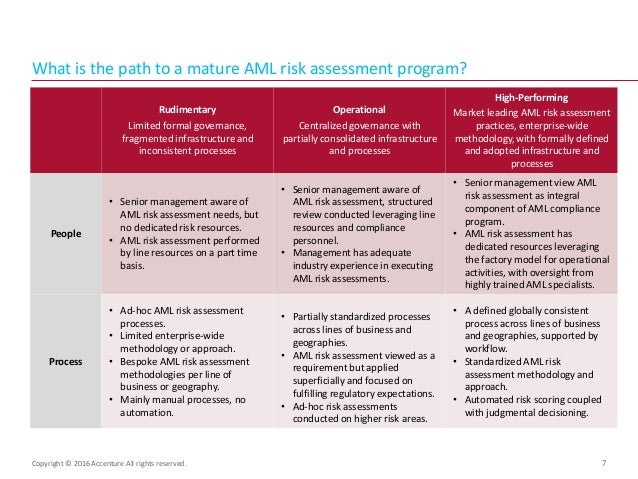

Anti Money Laundering Aml Risk Assessment Process

Anti Money Laundering And Counter Terrorism Financing

The Fifth Money Laundering Directive 5amld Explained In Detail By Yury Myshinskiy Medium

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk

Eu Policy On High Risk Third Countries European Commission

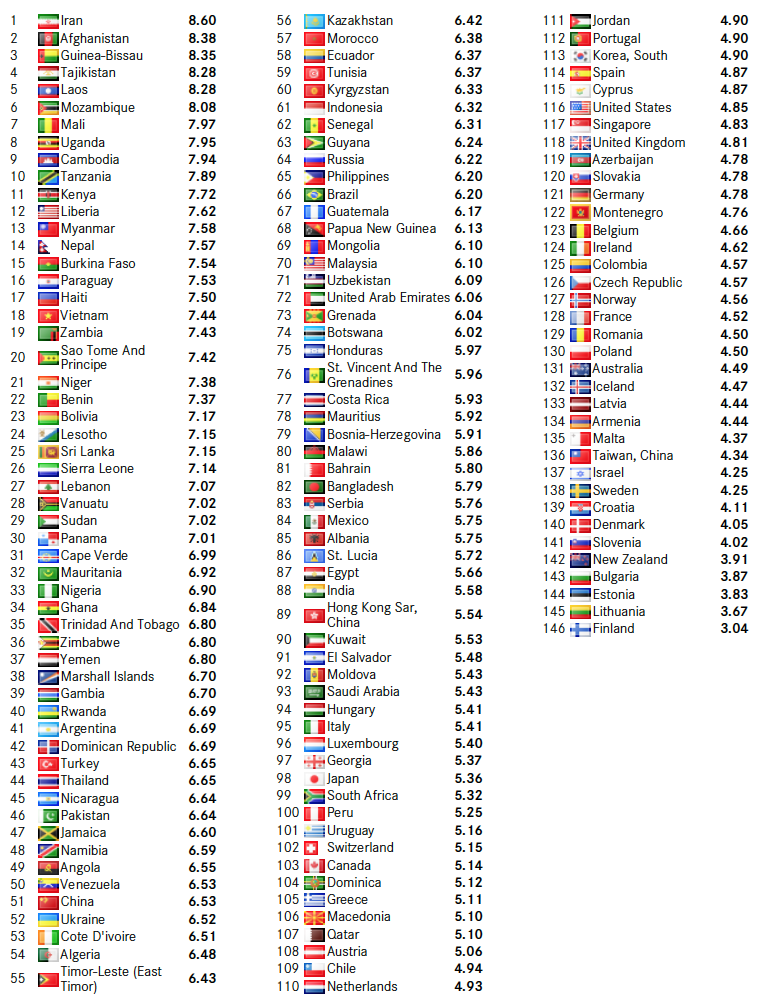

Global Money Laundering Risk Index Rises With Iran Rated Worst And Finland Least Risky Ctmfile

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk

The 4 Quadrants Of Politically Exposed Persons Complyadvantage

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

Anti Money Laundering And Counter Terrorism Financing

An Introduction To The 360 Degree Aml Investigation Model Acams Today

The world of rules can seem to be a bowl of alphabet soup at times. US cash laundering laws are no exception. Now we have compiled a listing of the highest ten money laundering acronyms and their definitions. TMP Danger is consulting agency centered on defending monetary providers by lowering danger, fraud and losses. We have now big financial institution experience in operational and regulatory risk. We have now a powerful background in program management, regulatory and operational danger as well as Lean Six Sigma and Enterprise Process Outsourcing.

Thus cash laundering brings many opposed penalties to the group as a result of dangers it presents. It will increase the probability of main dangers and the chance cost of the bank and ultimately causes the financial institution to face losses.

Komentar

Posting Komentar