pada tanggal

Love

- Dapatkan link

- Aplikasi Lainnya

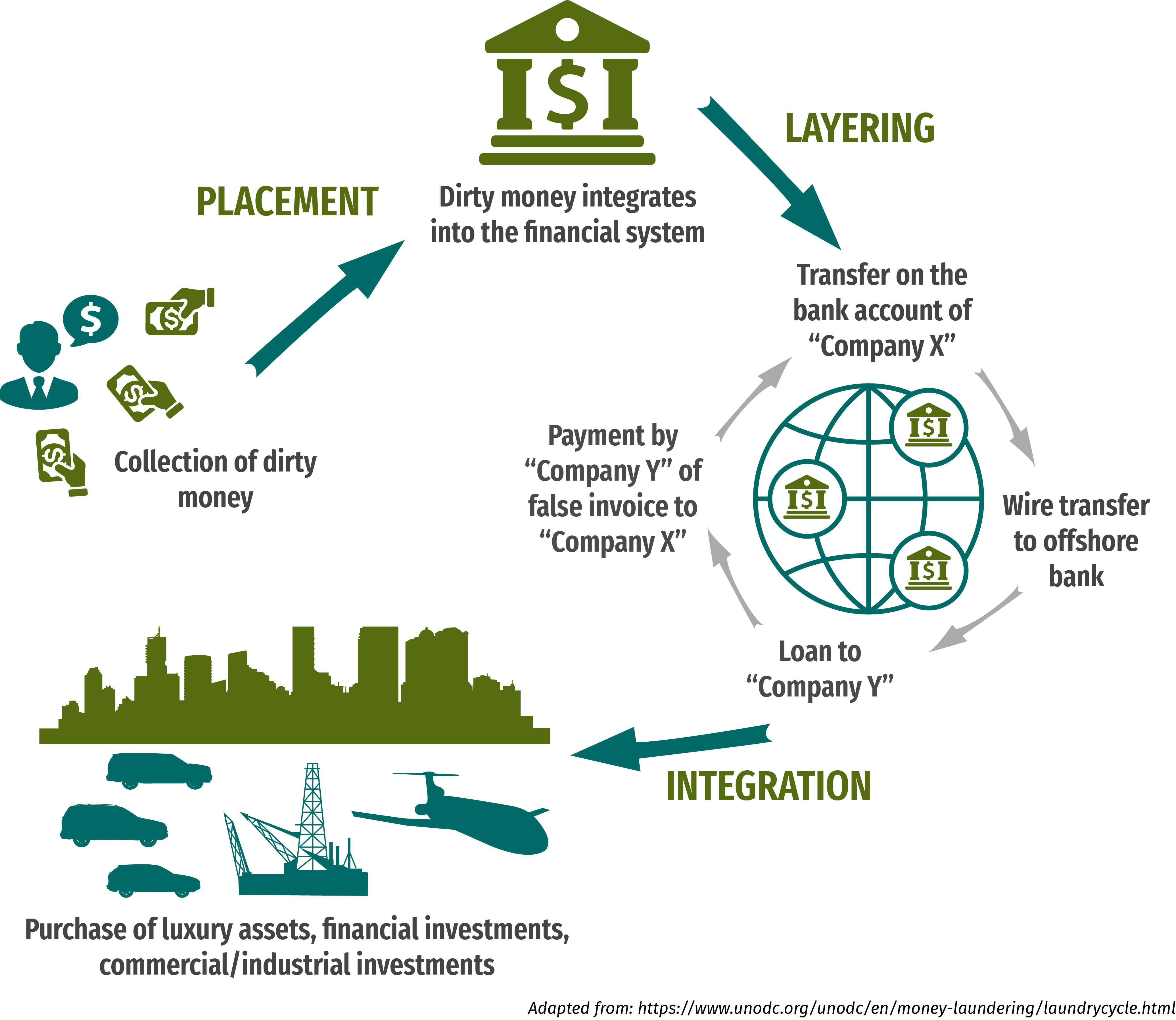

The idea of money laundering is essential to be understood for these working within the monetary sector. It's a course of by which soiled cash is converted into clear money. The sources of the money in actual are felony and the money is invested in a manner that makes it appear like clear cash and hide the id of the felony part of the money earned.

Whereas executing the monetary transactions and establishing relationship with the brand new customers or sustaining present clients the obligation of adopting satisfactory measures lie on every one who is a part of the organization. The identification of such ingredient to start with is simple to deal with instead realizing and encountering such conditions in a while in the transaction stage. The central financial institution in any country provides complete guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present enough security to the banks to discourage such conditions.

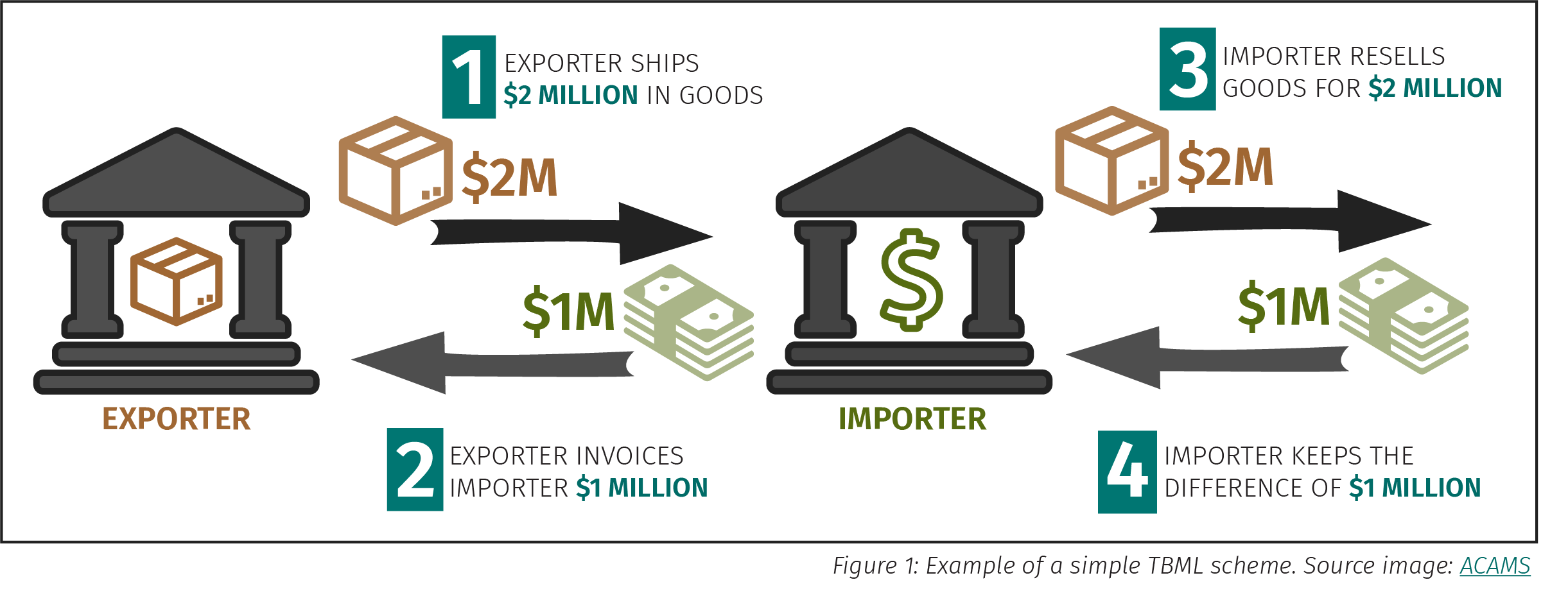

Over- and under-shipment ie short shipping of goods and services. Unfortunately this also creates an environment thats rife for abuse trade-based money laundering TBML accounts for hundreds of billions of dollars of illegal money flows annually.

Https Www Gov Im Media 1348726 Notice 1000 Man Trade Based Money Laundering July 18 Pdf

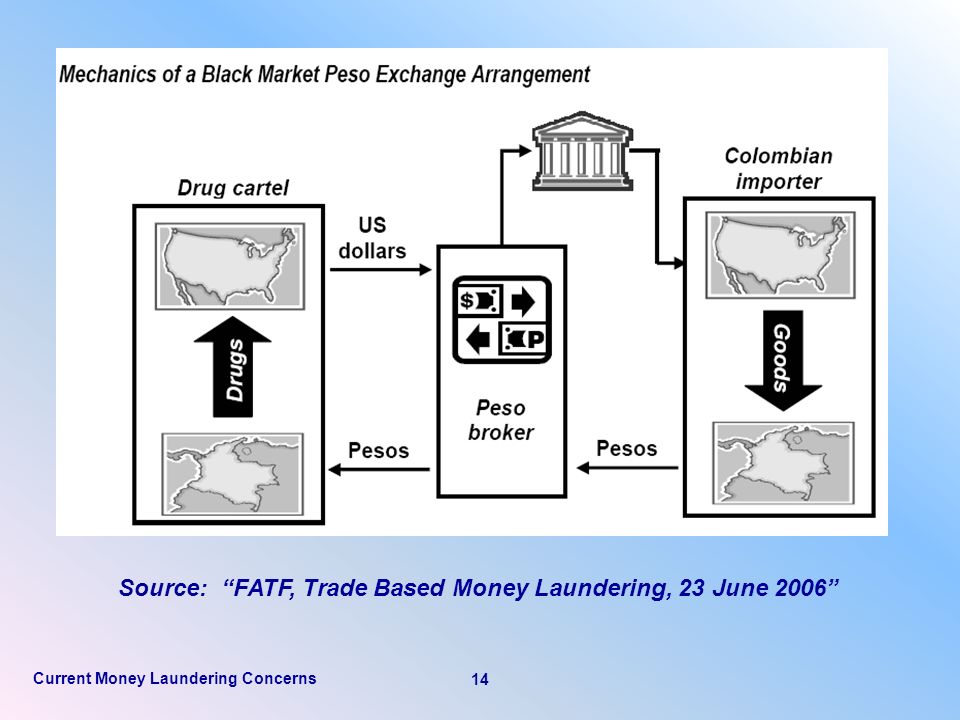

Trade based money laundering example. The tremendous volume of trade makes it easy to hide individual transactions The complexity that is involved in multiple foreign exchangecross border transactions. 1 Financial Action Task Force FATF Trade Based Money Laundering June 23 2006. To apply for Tax incentives when exporting certain goods Evading capital controls by placing overpaid funds into an offshore account Money laundering by creating artificial profits.

Defining trade-based money laundering and trade-based terrorist financing 11 Trade process and financing 12 Section 2. A letter of credit for a high-value cross-border import is revealed to contain anomalies when examined by the routing bank. Trade Based Money Laundering 2 2.

Precious metals stones consumer electronics military goods laser systems flying objects etc. Trade-based money laundering and associated tax evasion is big business. These red flags include the following.

A letter of credit for a high-value cross-border import is revealed to hide unusual behavior when examined by the routing bank. In practice this can be achieved through the misrepresentation of the price quantity or quality of imports or exports. The Trade Based Money Laundering paper published by the FATF has a list of red flag indicators that can be used proactively by bank trade finance departments.

Global trade complexities make tackling this type of money laundering difficult but not impossible. Examples of trade-based money laundering activities that should raise red flags include. For the purpose of this study trade-based money laundering is defined as the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimise their illicit origins.

The Trade Based Money Laundering paper published by the FATF has a list of red flag indicators that can be used proactively by bank trade finance departments. Significant discrepancies between the description of the commodity on a bill of lading and the invoice. Further investigation by the bank reveals missing and.

Examples of trade-based money laundering activities that should raise red flags including. International trade is huge. The type of commodity being shipped is designated as high risk for trade-based money laundering activities eg.

In 2016 world merchandise exports were valued at US 1546 trillion and the growth rate is projected over two percent annually. Trade-based money laundering and associated tax evasion is big business. Global trade complexities make tackling.

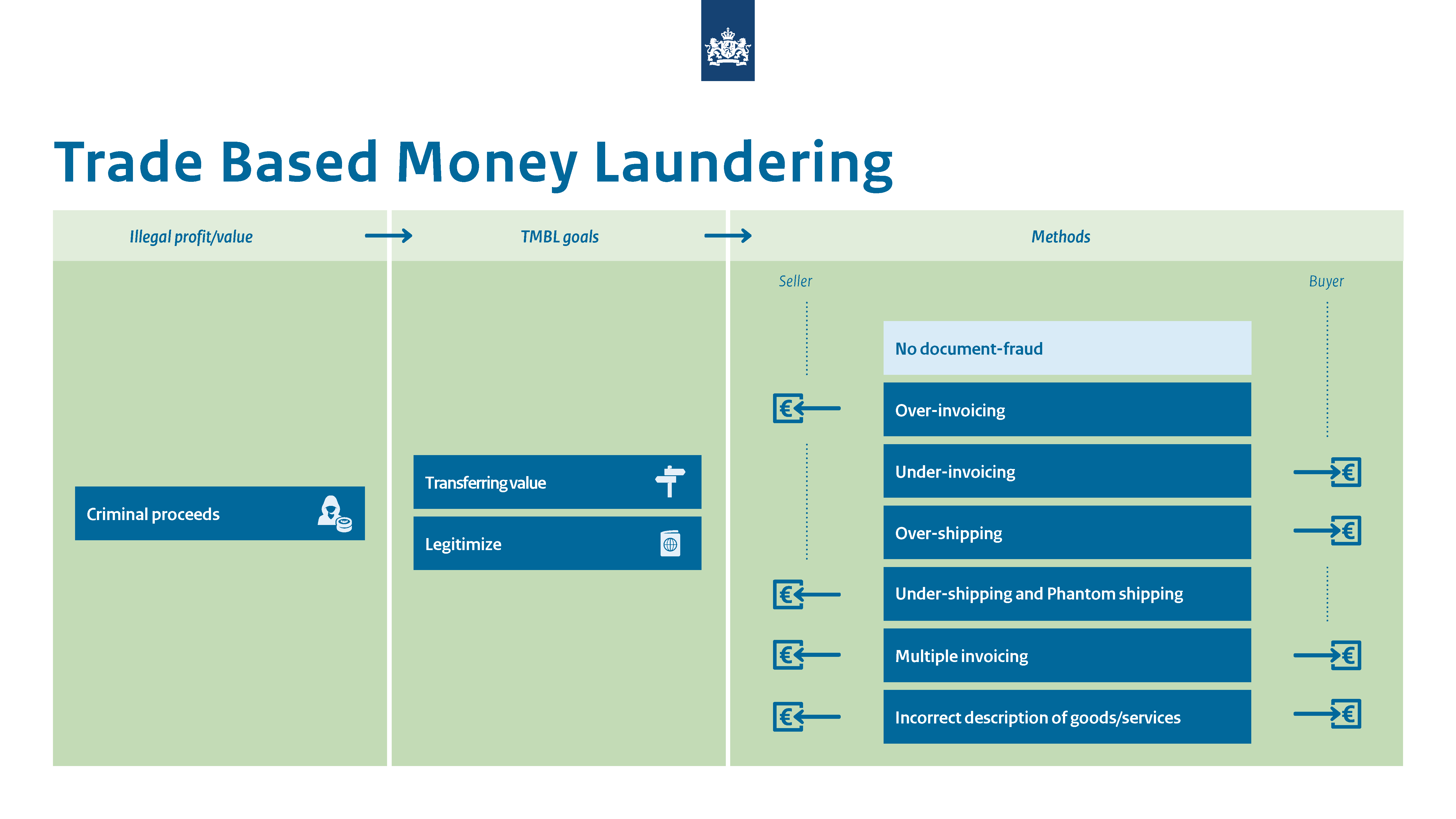

Financial losses from these crimes in developing countries totalled 9 trillion between 2008 and 2017. And falsely described goods and. The basic techniques of trade-based money laundering TBML include over- and under-invoicing of goods and services multiple-invoicing of goods and services.

Further investigation by the bank reveals missing and unrecognized documentation with. On Trade Based Money Laundering activities Why because trade has increasingly been used to launder money for criminal purposes Reasons for trades popularity. Trade-based money laundering risks and trends 15 Risk-based approach to trade-based money laundering 16 Economic sectors and products vulnerable to TBML activity 20 Types of businesses at risk of trade-based money laundering 24.

Wire 20000 to Company X including an extra 10000 of dirty money that has been laundered into clean funds. The scope of the TBML is vast as many commercial sectors covered by the anti-money laundering legislation are based on the ability of the meeting and exchange of goods between supply and demand. In its simplest definition trade-based money laundering is the process of disguising the proceeds of crime and moving value ie movement of money using.

Such actions may include moving illicit. For example the establishment and use of paper companies with the issuance of false - so-called non-existent - invoices or the use of methods such as over-invoicing under-invoicing and multiple. Financial losses from these crimes in developing countries totalled 9 trillion between 2008 and 2017.

The International Trade System The international trade system is subject to a wide range of risks and vulnerabilities which provide criminal organisations with the opportunity to launder the proceeds of crime and provide funding to terrorist organisations with a relatively low risk of detection. Trade-based money laundering relies on legitimate global trade channels to move and hide huge amounts of money. The crime involves a number of schemes in order to complicate the documentation of legitimate trade transactions.

High Risk Commodity.

What Is Trade Based Money Laundering Tbml Amlc Eu

Current Money Laundering Concerns Ppt Video Online Download

Tnrc Introductory Overview Trade Based Money Laundering And Natural Resource Corruption Pages Wwf

Https Www Gov Im Media 1348726 Notice 1000 Man Trade Based Money Laundering July 18 Pdf

Https Bb Org Bd Aboutus Regulationguideline Bfiu Dec112019 Guideline Tbml Pdf

Tnrc Introductory Overview Why Is Money Laundering A Critical Issue In Natural Resource Corruption Pages Wwf

Tanzania Financial Intelligence Unit Money Laundering Definition Kitengo Cha Kudhibiti Fedha Haramu Maana Ya Biashara Ya Fedha Haramu

Trade Based Money Laundering Gao Report Stresses Enforcement Challenges Money Laundering Watch

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Online Presentation

Https Events Development Asia System Files Materials 2019 06 201906 Basic Anti Money Laundering Aml And Trade Based Money Laundering Concepts Pdf

Current Money Laundering Concerns Ppt Video Online Download

How Can Trade Finance Anti Money Laundering Monitoring Be Improved Acams Today

Press Release Press Releases Newsroom U S Senator Bill Cassidy Of Louisiana

The world of regulations can appear to be a bowl of alphabet soup at occasions. US money laundering regulations are not any exception. We've compiled a list of the highest ten cash laundering acronyms and their definitions. TMP Danger is consulting firm focused on defending monetary providers by reducing risk, fraud and losses. We've massive bank expertise in operational and regulatory risk. We now have a strong background in program management, regulatory and operational risk in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus money laundering brings many hostile consequences to the organization as a result of dangers it presents. It will increase the likelihood of main dangers and the opportunity cost of the financial institution and in the end causes the financial institution to face losses.

Komentar

Posting Komentar